Employers were given a gift of sorts from the IRS and the ACA when extensions for paper filings were extended to 5/31/16 and electronic filings were extended to 6/30/16. Perhaps that still wasn’t enough time for your company to get the job done.

While the risk of penalties is still inevitable for noncompliant companies, it’s best to understand how severe they can be should you soar way past the filing deadlines. A few pointers:

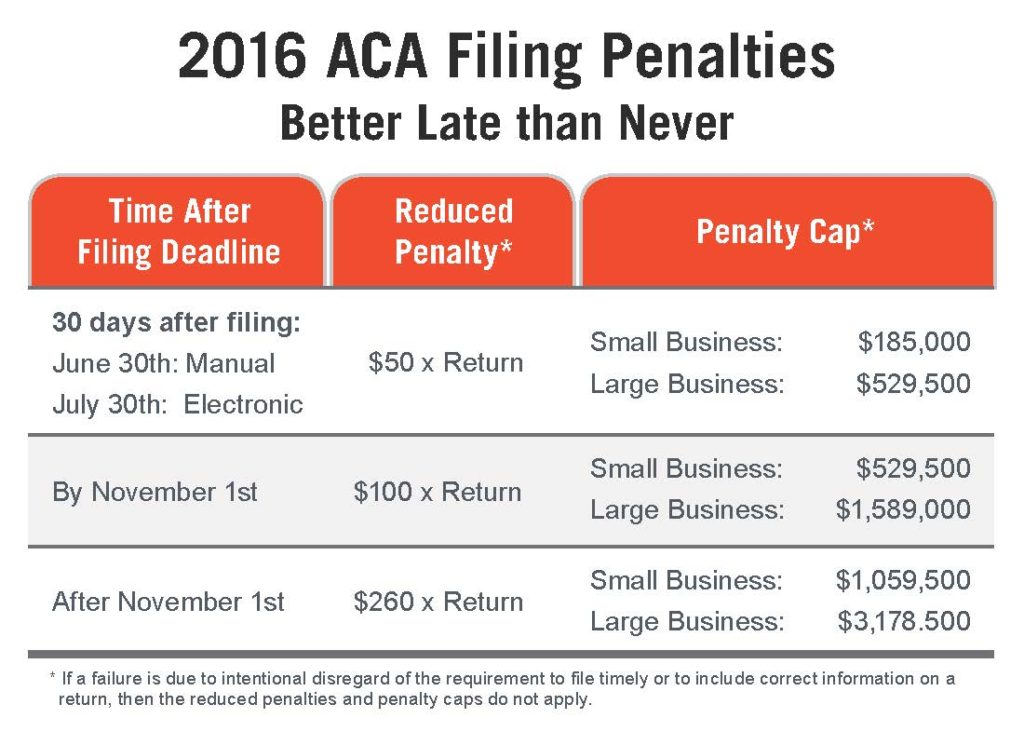

First, these penalties are per return. That means per employee whose forms you have to file. The numbers escalate as the dates lapse. While the 30-day deadlines are now gone as of July 31st, so is the $50 penalty per return.

Waiting until November 1, 2016 will up those penalties to $100 per return. After November 1, 2016? $260 per return. There are limits to the penalties for small and large businesses, but some can see the multi-millions in penalties. The solution? It’s better late than never, so hurry up and file.

Below is an easy to read table showing penalties for late ACA filers.