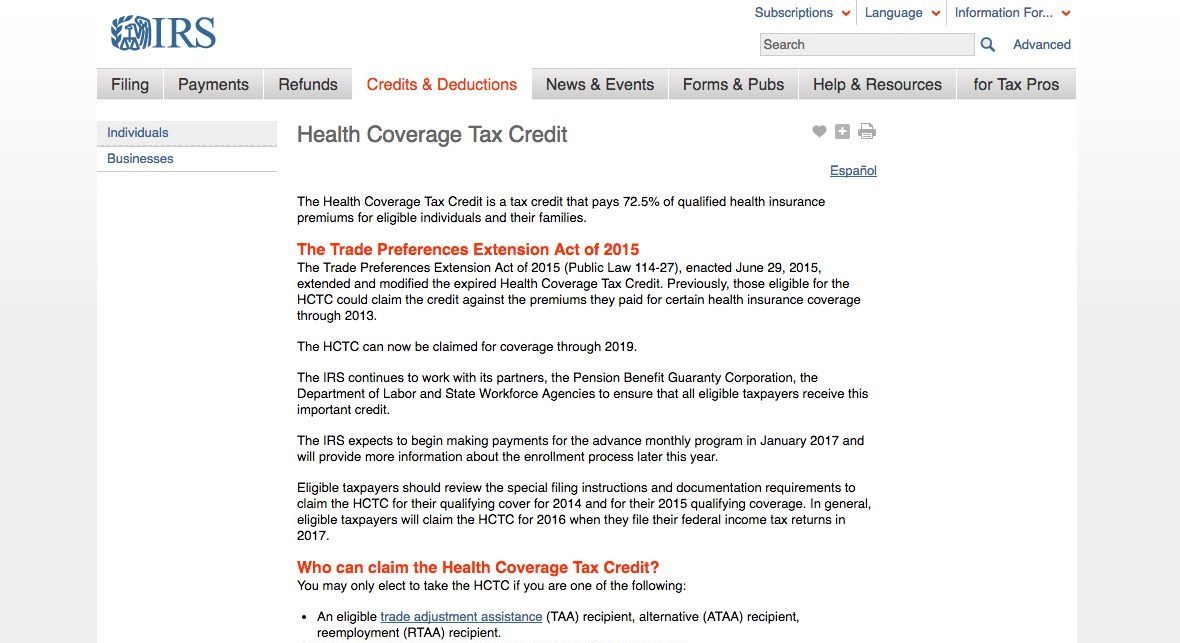

The IRS has issued Notice 2016-02 to provide information regarding the health coverage tax credit, or HCTC. The 14-page notice explains who can claim the HCTC, the amount of the credit, and the procedures to claim the credit for tax years 2014 and 2015.

This notice also provides guidance for taxpayers eligible to claim the HCTC who enrolled in a qualified health plan offered through a Health Insurance Marketplace in tax years 2014 or 2015, and who claimed or are eligible to claim the premium tax credit under section 36B.