1 minute read:

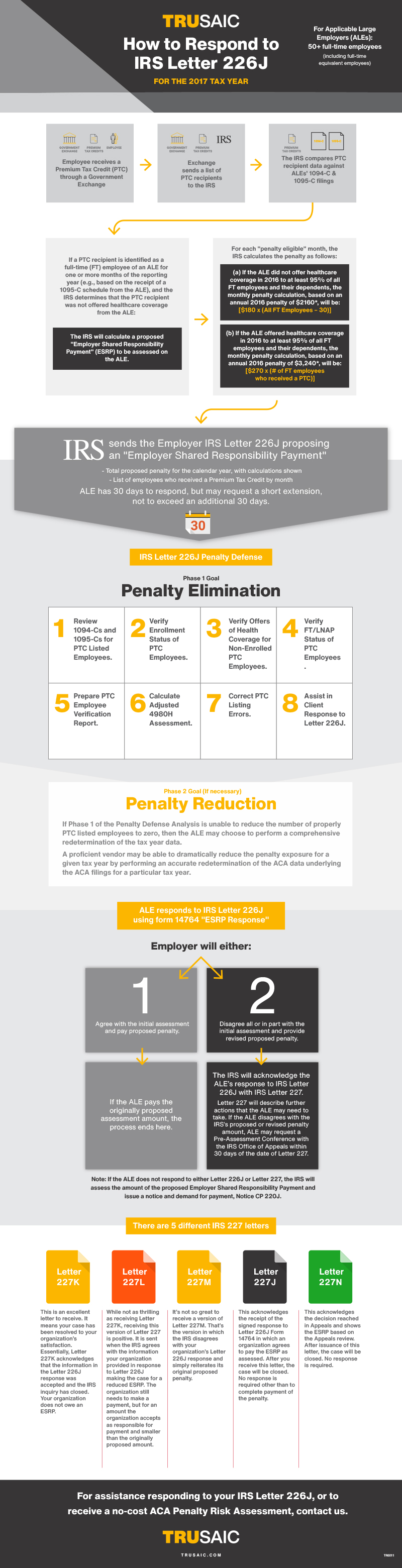

IRS staff has confirmed that the IRS is issuing Letter 226J penalty notices for the 2017 tax year.

If you receive a Letter 226J, you have 30 days to respond. The process your organization undertakes to develop the response to this Letter 226J needs to be focused and efficient. The tax agency recently said it would be limiting employers that receive IRS Letter 226J penalty notices to one 30-day extension request for additional time to respond. That 30-day extension policy would be applied to each IRS notice received in the penalty process.

Last year, we issued an infographic to help employers navigate their response to Letter 226J for the 2016 tax year.

We have updated our guide specifically for the 2017 tax year to help employers prepare for this new round of penalty notices.

Please click here to download a printable version of the infographic.

![How to Respond to IRS Letter 226J for the 2017 Tax Year [INFOGRAPHIC]](https://acatimes.com/wp-content/uploads/AdobeStock_125494126_1280px-300x200.jpg)

![How to Respond to IRS Letter 226J for the 2017 Tax Year [INFOGRAPHIC]](https://acatimes.com/wp-content/uploads/AdobeStock_125494126_1280px.jpg)