Over the last two years, the IRS has made some strides in ensuring that certain ACA-mandated processes are as seamless as possible for taxpayers and employers, from streamlining electronic form filings to working toward virtual interactions with the IRS from home.

The IRS reported earlier this year that the form rejection rate from the Affordable Care Act Information Return Form (AIR) fell from 4.5% in 2016 to 1% in 2017. The number of information returns that were accepted with errors fell from 6% to 3.8%.

While that is good news, vendors can still find navigating the AIR system challenging. And as employers turn to software solutions in hopes of streamlining ACA-mandated filings with the IRS, there still can be problems. For instance, a report from the National Taxpayer Advocate discovered in March 2017 that a technological blip caused a certain tax preparation software to incorrectly calculate Premium Tax Credits (PTCs) or failed to submit PTC Form 8962. The result was the misfiling of approximately 2,279 tax returns. For those companies involved, technology is still an issue despite the advances reported by the IRS.

And we’ve learned all too frequently from past tax mistakes and misfiling that such margins of error can lead to hefty penalties.

How can employers protect their pockets from potential fines? Here are some effective ways:

- Working with software or a software solution provided can lull you into a false sense of security. Its accuracy is assumed. However, as this 2017 software glitch demonstrates, software alone is not enough of a safeguard to protect you from filing errors and data inaccuracies.Have employees trained for ACA compliance available to review processes and all paperwork prior to filing, as well as to doublecheck software outputs. Better yet, find a third-party provider that is in the business of providing technology, data consolidation expertise and expert human resources to work on your ACA compliance requirements and filings.

Download the printable version below.

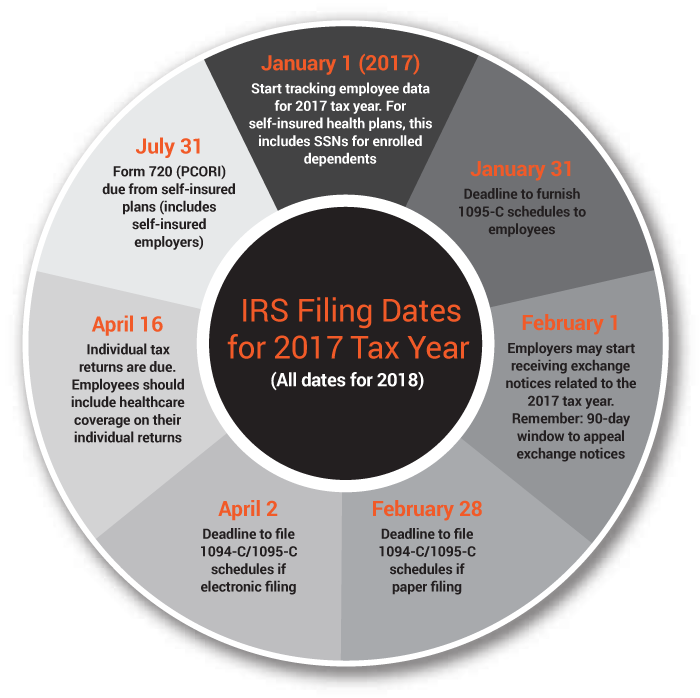

Download the printable version below. - Know IRS filing deadlines and keep them handy. Make sure you have a process in place to gather, consolidate and validate your data in time to meet filing deadlines. Best practices say you should aggregate, consolidate, and validate year-to-date data from HR, Time & Attendance, Payroll and Health Benefits each month.

- Maintain a system where forms and documentation used for your ACA filing are readily available and organized in case they are needed to address an ACA exchange notice or an IRS ACA audit. Even better, find a third-party provider for ACA compliance services that will defend you in such situations.

Download the Printable 2017 ACA Timeline