The IRS reminds employers that, beginning in 2016, the Affordable Care Act requires them and other providers of minimum essential coverage to report certain information about employees’ health coverage in 2015 to the IRS and to covered individuals.

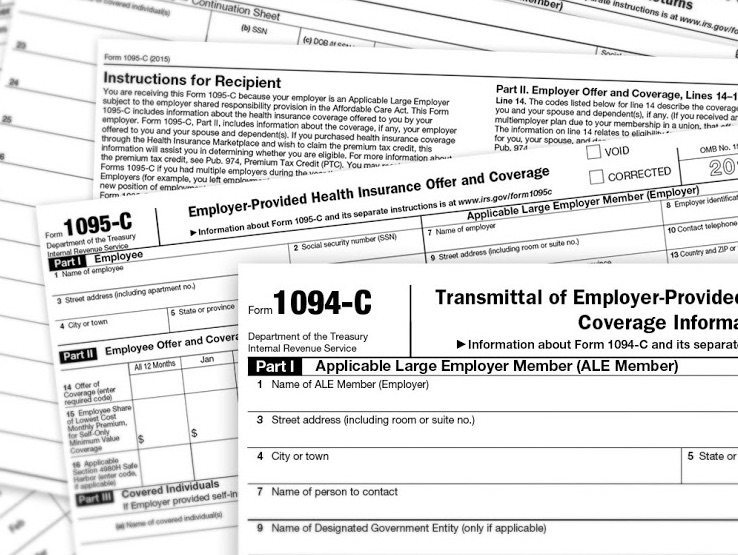

Information will be provided to individuals on Form 1095-B, Health Coverage Information Return or Form 1095-C, Employer-Provided Health Insurance Offer and Coverage. Taxpayers will use this information when they file their tax returns, to verify the months they had coverage which satisfied the individual shared responsibility provision.

The IRS will use the information on the statements to verify the months of the individual’s coverage.

The deadlines for reporting about 2015 coverage are Feb. 1, 2016 for sending the form to employees, and Feb. 29, 2016 for filing the information with the IRS on paper, or Mar. 31, 2016 if filing is done electronically.

Employers that sponsor self-insured group health plans are subject to information reporting requirements with respect to the self-insured group health plan coverage. This means an employer who sponsor a self-insured group health plan for a workforce of any size must comply with these information reporting requirements.

An employer that is an applicable large employer must use Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, and Form 1095-C to report information for employees who enrolled in the employer-sponsored self-insured health coverage.

An employer that is not an applicable large employer should not file Forms 1094-C and 1095-C, but should instead file Forms 1094-B and 1095-B to report information for employees who enrolled in the employer-sponsored self-insured health coverage.

Other providers of minimum essential coverage will file Form 1094-B, Transmittal of Health Coverage Information Returns, and Form 1095-B, Health Coverage Information Return, with the IRS.

The Form 1095-B must contain the name and taxpayer identification numbers for each covered individual. It must also include the months that each covered individual was enrolled in coverage and entitled to receive benefits for at least one day of that month.

Coverage providers also must send the Form 1095-B to the person identified as the responsible individual on the form. The responsible individual generally is the person who enrolls one or more individuals, which may include him or herself, in minimum essential coverage. For 2015 coverage, the deadline for providing this form to individuals is February 1, 2016.

For more about the information reporting requirements for coverage providers, including self-insured employers, see the Questions and Answers on IRS.gov/aca.