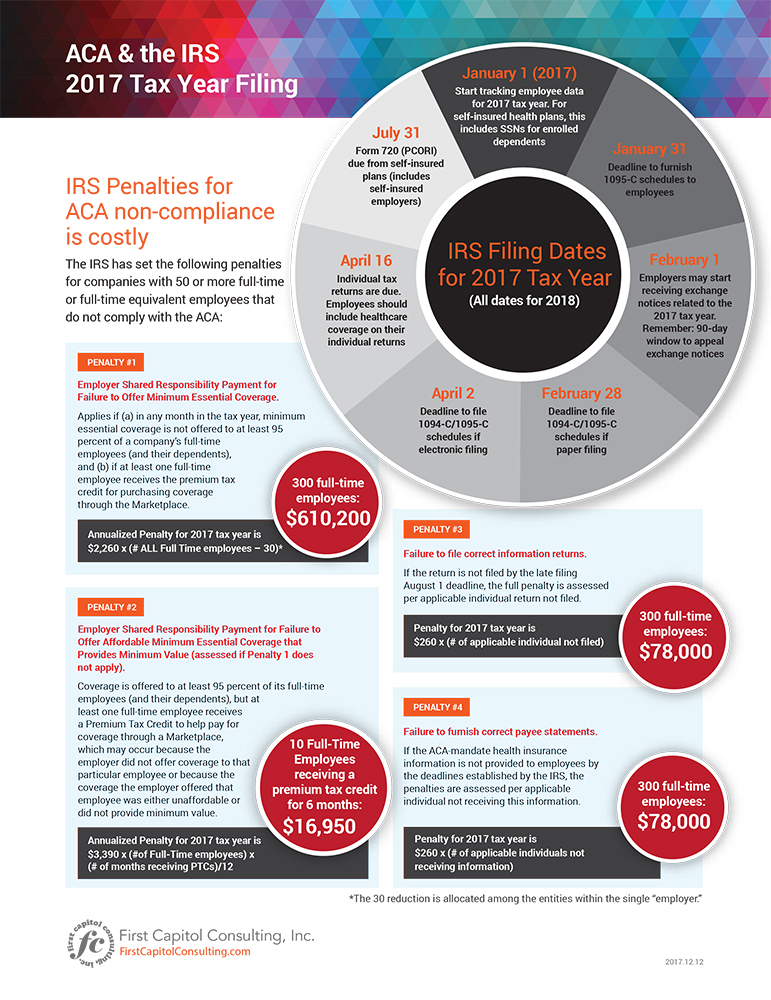

The IRS has announced the penalty amounts for companies with 50 or more full-time or full-time equivalent employees that do not comply with the Affordable Care Act (ACA) for the 2017 tax year. This information takes on more importance now that we know the IRS is going to enforce the employer mandate for the ACA.

The

Now that this enforcement process is in place, we can anticipate that it will continue for the 2016 tax year and upcoming ACA filings with the IRS for the 2017 tax year.

This is what you can expect to pay in penalties if you fail to comply with the ACA for the 2017 tax year. We’ll use XYZ Corporation with its 300 full-time employees as our example.

Penalty 1: Employer Shared Responsibility Payment (ESRP) for Failure to Offer Minimum Essential Coverage. This applies if (a) in any month in the tax year, minimum essential coverage is not offered to at least 95 percent of a company’s full-time employees (and their dependents), and (b) if at least one full-time employee receives the premium tax credit for purchasing coverage through the Marketplace. The penalty is assessed against all your employees in the organization, not just the ones receiving the PTCs.

This annualized penalty is calculated as follows: $2,260 x (# ALL Full-Time employees – 30). For instance, XYZ Corporation with 300 full-time employees would be liable for $610,200. The IRS allows each organization to subtract 30 employees from its total employee count, regardless of the number of locations at which employees are located.

Penalty 2: Employer Shared Responsibility Payment for Failure to Offer Affordable Minimum Essential Coverage that Provides Minimum Value (assessed if Penalty 1 does not apply). This applies if healthcare coverage is offered to at least 95 percent of full-time employees (and their dependents), but at least one full-time employee receives a Premium Tax Credit (PTC) to help pay for coverage through a government marketplace, which may occur because the employer did not offer coverage to that particular employee or because the coverage the employer offered that employee was either unaffordable or did not provide minimum value. In this circumstance, XYZ Corporation would be assessed a penalty against only the employees receiving the PTCs, not the full-time employee count of 300.

The annualized penalty is calculated as follows: $3,390 x (# of Full-Time employees receiving PTCs) x (# of months receiving PTCs)/12. For example, if XYZ Corporation has 10 full-time employees that received PTCs for six months (50% of the year), it would pay a penalty of $16,950.

Penalty 3: Failure to file correct information returns. If the return is not filed by the filing deadline, the full penalty is assessed per applicable individual return not filed.

This penalty is calculated as follows: $260 x (# of applicable individual forms not filed). For example, if XYZ Corporation failed to file 1095-C forms for its 300 employees by the filing deadline, it would pay $78,000.

Penalty 4: Failure to furnish correct payee statements. If the ACA-mandate health insurance information is not provided to employees by the deadlines established by the IRS, the penalties are assessed per applicable individual not receiving this information.

This penalty is calculated as follows: $260 x (# of applicable individual forms not filed). For example, if XYZ Corporation missed the deadline to provide its 300 employees with form 1095-C, it would pay $78,000.

With half the businesses in the U.S. saying they are not confident in their ability to satisfy ACA requirements, and reported penalties in the millions of dollars being assessed by the IRS, it’s important to offer appropriate healthcare coverage to employees and that employees understand that healthcare coverage is being offered. It is equally important to be sure that this information is accurate in the ACA filings made with the IRS.

You may want to consider hiring an outside expert to help you consolidate your data to get on track for meeting IRS deadlines for the 2017 tax year filings. With IRS penalties increasing, it may prove to be a worthwhile investment to avoid problems posed by filing inaccurate information and the possibility of being assessed IRS penalties.

Click here to download a printable version.