5 minute read:

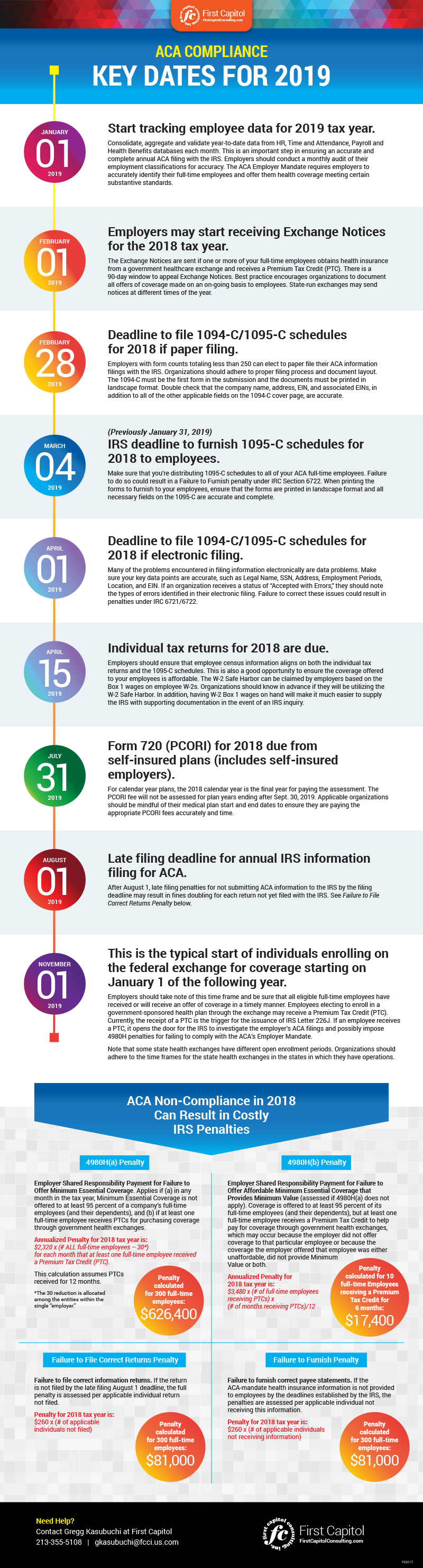

Every year, the IRS requires employers to submit important ACA information to the agency and their employees. Here are some important dates to keep in mind for successful ACA compliance and submitting ACA information for the 2018 tax year to the IRS to avoid being assessed penalties.

Below are a list of 2019 deadlines for providing ACA information to the IRS for the 2018 tax year:

- February 28, 2019: Deadline to file 1094-C / 1095-C schedules for 2018 if paper filing.

- March 4, 2019 (Previously January 31, 2019): IRS deadline to furnish 1095-C schedules for 2018 to employees.

- April 1, 2019: Deadline to file 1094-C / 1095-C schedules for 2018 if electronic filing.

- July 31, 2019: Form 720 (PCORI) for 2018 due from self-insured plans (includes self-insured employers).

- August 1, 2019: Late filing deadline to file 1094-C / 1095-C schedules for 2018.

Here are more details on the IRS filing deadlines:

February 28, 2019

Deadline to file 1094-C /1095-C schedules for 2018 if paper filing.

This applies to employers with total form counts (less than 250) can elect to paper file their ACA information filings with the IRS. Organizations should adhere to proper filing process and document layout. The 1094-C must be the first form in the submission and the documents must be printed in landscape format. Double check that the Company Name, Address, EIN, and associated EINs, in addition to all of the other applicable fields on the 1094-C cover page, are accurate.

March 4, 2019 (Previously January 31, 2019)

IRS deadline to furnish 1095-C schedules for 2018 to employees.

Make sure that you’re distributing 1095-C schedules to all of your ACA full-time employees. Failure to do so could result in a Failure to Furnish penalty under IRC Section 6722. When printing the forms to furnish to your employees, ensure that the forms are printed in landscape format and all necessary fields on the 1095-C are accurate and complete.

April 1, 2019

Deadline to file 1094-C/1095-C schedules for 2018 if electronic filing.

Many of the problems encountered in filing information electronically are data problems. Make sure your key data points are accurate, such as Legal Name, SSN, Address, Employment Periods, Location, and EIN. If an organization receives a status of “Accepted with Errors,” they should note the types of errors identified in their electronic filing. Failure to correct these issues could result in penalties under IRC 6721/6722.

July 31, 2019

Form 720 (PCORI) for 2018 due from self-insured plans (includes self-insured employers).

For calendar year plans, the 2018 calendar year is the final year for paying the assessment. The PCORI fee will not be assessed for plan years ending after Sept. 30, 2019. Applicable organizations should be mindful of their medical plan start and end dates to ensure they are paying the appropriate PCORI fees accurately and time.

August 1, 2019

Late filing deadline for submitting annual ACA information to the IRS.

After August 1, late filing penalties for not submitting ACA information to the IRS by the filing deadline may result in fines doubling for each return not yet filed with the IRS. See Failure to File Correct Returns Penalty below.

Of course, ACA compliance goes beyond knowing when to file ACA information with the IRS. It takes an ongoing commitment to ensure the accuracy of the data that forms the foundation of successful ACA compliance. Here some additional dates to keep in mind:

January 1, 2019

Start tracking employee data for the 2019 tax year.

Consolidate, aggregate and validate year-to-date data from HR, Time and Attendance, Payroll and Health Benefits databases each month. This is an important step in ensuring an accurate and complete annual ACA filing with the IRS. Employers should conduct a monthly audit of their employment classifications for accuracy. The ACA Employer Mandate requires employers to accurately identify their full-time employees and offer them health coverage meeting certain substantive standards. If you have not started doing this in January, it’s never too late to start this month.

February 1, 2019

Employers may start receiving Exchange Notices for the 2018 tax year.

The Exchange Notices are sent if one or more of your full-time employees obtains health insurance from a government healthcare exchange and receives a Premium Tax Credit (PTC). There is a 90-day window to appeal Exchange Notices. Best practice encourages organizations to document all offers of coverage made on an ongoing basis to employees. State-run exchanges may send notices at different times of the year.

April 15, 2019

Individual tax returns for 2018 are due.

Employers should ensure that employee census information aligns on both the individual tax returns and the 1095-C schedules. This is also a good opportunity to ensure the coverage offered to your employees is affordable. The W-2 Safe Harbor can be claimed by employers based on the Box 1 wages on employee W-2s. Organizations should know in advance if they will be utilizing the W-2 Safe Harbor. In addition, having W-2 Box 1 wages on hand will make it much easier to supply the IRS with supporting documentation in the event of an IRS inquiry.

November 1, 2019

This is the typical start of individuals enrolling on the federal exchange for coverage starting on January 1 of the following year.

Employers should take note of this time frame and be sure that all eligible full-time employees have received or will receive an offer of coverage in a timely manner. Employees electing to enroll in a government-sponsored health plan through the exchange may receive a PTC. Currently, the receipt of a PTC is the trigger for the issuance of IRS Letter 226J. If an employee receives a PTC, it opens the door for the IRS to investigate the employer’s ACA filings and possibly impose 4980H penalties for failing to comply with the ACA’s Employer Mandate.

Note that some state health exchanges have different open enrollment periods. Organizations should adhere to the time frames for the state health exchanges in the states in which they have operations.

Adhering to these steps will improve ACA compliance and ensure accurate and timely ACA reporting, avoiding the associated penalties, including those in IRS Letter 226J, which the IRS is now issuing for the 2016 tax year, and penalties to organizations that failed to file forms 1094-C and 1095-C with the IRS or furnish 1095-C forms to employees under IRC 6721/6722 for the 2015 and 2016 tax years using Letter 5005-A and Form 866-A.

As you head into the 2019, use the infographic below as a reminder of these important dates.