Well over a million low-income Americans could lose the subsidies they receive  under the Affordable Care Act because they failed to file federal income tax returns, failed to include IRS Form 8962 with their return, or filled out that form incorrectly.

under the Affordable Care Act because they failed to file federal income tax returns, failed to include IRS Form 8962 with their return, or filled out that form incorrectly.

The subsidies, which on average cover 70% of the cost of the insurance, are available to individuals and families with incomes at least equal to the federal poverty line (FPL) up to four times the FPL. Subsidy recipients must file a tax return, even if they would otherwise not be required to file. They must also submit Form 8962 with the return.

According to the IRS, 710,000 people who receive ACA subsidies had failed to file a tax return by July, and had not requested extensions of time to file.

In addition, 760,000 other taxpayers who received subsidies had filed their tax returns, but had not included the required Form 8962.

Recipients who have not correctly filed their returns and required forms are at risk of losing their subsidies for the coming year. The IRS sent them letters in July warning that they would get no subsidy in 2016, and could be required to repay some or all of the subsidy payments they have already received, if they didn’t file.

Exacerbating the subsidy problem, an unknown number of subsidy recipients submitted Form 8962, but made errors.

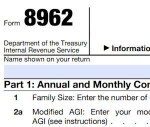

The form requires taxpayers to calculate their family’s “modified AGI,” “household income as a percentage of Federal Poverty Line,” “premium tax credit claim and reconciliation of advance payment of premium tax credit,” “shared policy allocation” and much more.

“The premium tax credit form, the dreaded 8962, is really hard,” Eileen P. Duggan, a Missouri piano teacher who filed the form with her taxes, told New York Times writer Robert Pear. “It was almost impossible to figure out.”

The IRS says subsidy recipients who failed to file a tax return and Form 8962 should file them as soon as possible. That will allow them to attest on federal and state marketplaces, as they shop for 2016 coverage, that they have fulfilled their obligation to file and thus are eligible for continued subsidies.