3 minute read:

The IRS has not let up with issuing ACA penalties to employers identified as having failed to comply with the law’s Employer Mandate. As in past tax years, penalties for failing to comply with the ACA have increased for 2019.

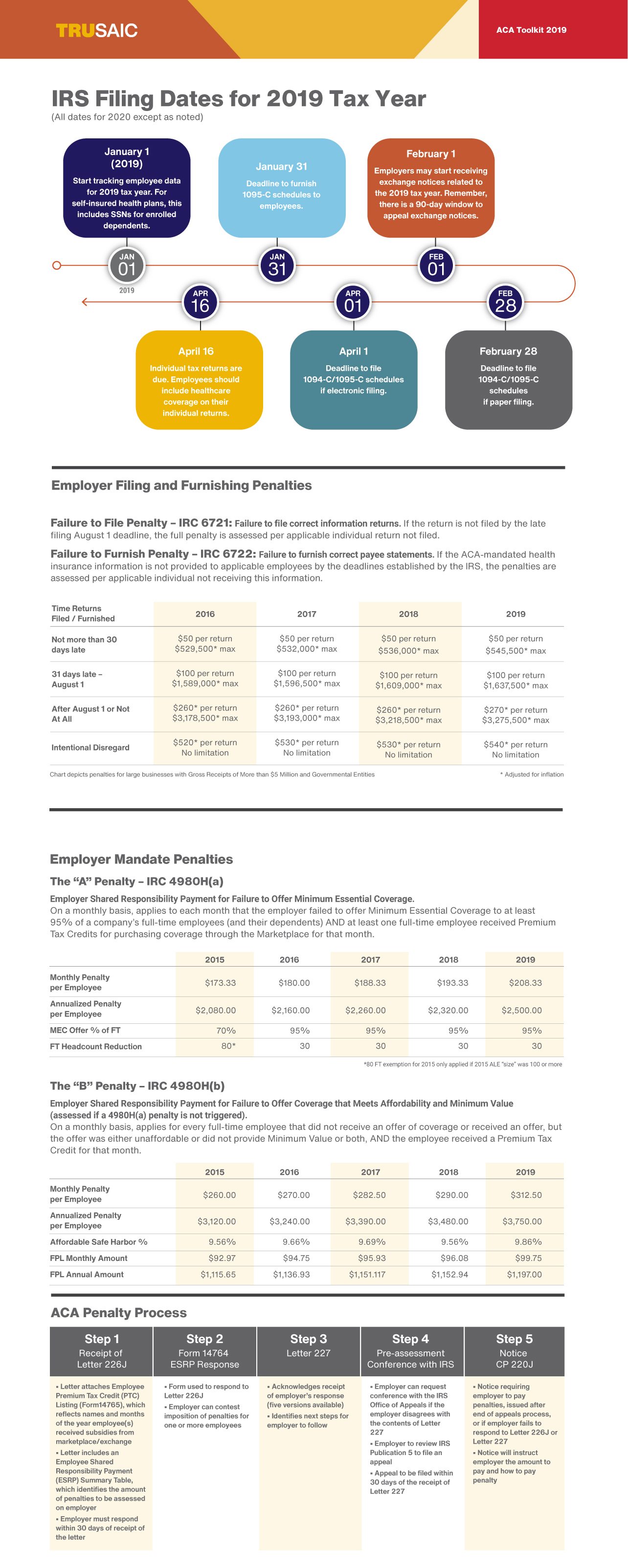

For the 2019 tax year, the annual penalty amounts for ACA penalties are anticipated to be $2,500 for the 4980H(a) penalty and $3,750 for the 4980H(b) penalty.

When the ESRP penalties were first established in 2014, the penalties started at $2,000 for 4980H(a) annually and $3,000 for 4980H(b) annually. Every year since then, the amount has increased due to indexing of the premium adjustment percentage. The method for calculating this can be attributed to the premium adjustment percentage, which the notice discusses in detail.

Organizations should also note that for the 2019 tax year, the affordability component for satisfying the 4980H(b) component of the ACA’s Employer Mandate is set to 9.86% of the Federal Poverty Level (FPL). That comes out, for an individual, based on the mainland FPL to $99.75 a month or $1,197 annualized.

Penalties for failing to comply with IRC 6721/6722 for the 2019 tax year have increased as well.

Failing to furnish, or distribute, Forms 1095-C for 2019 to applicable employees by January 31, 2020, makes employers subject to a $50 penalty per return, not to exceed an annual maximum of $556,500 ($194,000 for small businesses), if the forms are distributed to employees within 30 days past the deadline. After 30 days and through August 1, the amount per return jumps up to $110, not to exceed an annual maximum of $1,669,500 ($556,500 for small businesses). After August 1 or not at all, the penalty amount steepens to $270 per return, not to exceed an annual maximum of $3,339,500 ($1,113,000 for small businesses). For intentional disregard, the penalty more than doubles after August 1 to $550 per return, and there is no annual maximum limit.

Half of 2019 is over, and employers should be aware of the financial risk associated with failing to comply with the ACA’s Employer Mandate. The IRS is currently issuing Letter 226J penalty assessments for the 2017 tax year and penalties are projected to increase for years following 2019.

Under the ACA’s Employer Mandate, Applicable Large Employers (ALEs), organizations with 50 or more full-time employees and full-time equivalent employees, are required to offer Minimum Essential Coverage (MEC) to at least 95% of their full-time workforce (and their dependents) whereby such coverage meets Minimum Value (MV) and is Affordable for the employee or be subject to IRC Section 4980H penalties.

If you’re an employer that hasn’t complied with the ACA’s Employer Mandate, you could be putting your company at serious financial risk. If you’re interested in keeping this information on hand, as well as the most common ACA compliance mistakes, check out our ACA 101 Toolkit 2019 Edition below. You can also download it here.