Companies with 50 or more full-time employees should be gathering information now  for Affordable Care Act reports they will have to provide to the IRS and to their employees early in 2016.

for Affordable Care Act reports they will have to provide to the IRS and to their employees early in 2016.

All companies of this size, dubbed “applicable large employers” by the IRS, must report whether they offered a health plan with “minimum essential coverage” to their full-time employees and their dependents. They must also report details of the coverage, each employee’s share of the cost, hours worked and other details.

If a company is jointly owned by other companies – for example, several franchise restaurants with one owner, or two companies owned by an investor – the “controlled group” is considered a single applicable large employer, or ALE, and must submit reports to the IRS for all companies in the group.

The reporting is related to the ACA’s requirement that all Americans have minimum essential health insurance coverage, either through their employer or purchased individually. If an employer is large enough to be required to offer coverage but fails to do so, and one or more of its employees receives a government subsidy to purchase insurance, the employer may be subject to penalties.

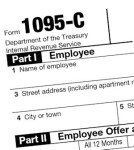

The Form 1095-C information returns ALEs must file are due by the end of February 2016 if filed on paper, and a month later if filed electronically, which is required for ALEs with 250 or more returns. Extensions may be available through the filing of IRS Form 8809.

The ALE must state whether they offered their full-time employees, and the employees’ dependents, the opportunity to enroll in a company-sponsored plan with minimum essential coverage – either an employer-sponsored plan or a group insurance plan.

The ALE must also report the number of full-time employees for each month during the calendar year, along with the name, address and Social Security number or taxpayer ID. These numbers on the employee statements can be truncated (for example, just the last four digits) to help protect against identity theft.

For each employee, the report much includes the months during the year for which health coverage was available, the months the employee was covered under the plan and the employee’s share of the lowest cost monthly premium for minimum value health coverage.

The IRS provides a simplified alternative to reporting information about each employee. To take advantage of this, the employer must offer minimum-value coverage to the employee and his or her family at a cost to the employee of no more than $1,100 for employee-only coverage. (This amount, 9.5% of the Federal Poverty Level, may change each year.)

If the employer makes a “qualifying offer” of this kind, the company can report just the names, addresses and IDs of employees who worked the full year, and state that the employees received a full-year qualifying offer.

Copies of Form 1095-C must be provided to employees, including information specific to the individual employee.

Companies can also simply their reporting by qualifying for the “98% offer” exemption. An ALE that certifies that it offered minimum essential coverage that was affordable to at least 98% of its employees and their dependents does not have to report the total number of employees or the months during the year when an employee was working full-time.

Employers can provide copies of Form 1095-C to employees on paper or, if the employee agrees, in electronic form.

An employer who fails to file Form 1095-C, or includes incorrect or incomplete information, may be subject to penalties.