Perhaps only time will tell if President Trump can succeed where Republicans in Congress have failed to obliterate the Affordable Care Act (ACA). The President’s ambitious attempts to derail the ACA has been going on since he came to office, but those efforts were taken to another level last week.

The recent ACA executive order signed by President Trump focused on three areas he claims will provide better healthcare choices for Americans:

1. Expanding access to Association Health Plans (AHPs), which could potentially allow American employers to form groups across state lines.

2. Expanding healthcare coverage through low cost short-term limited duration insurance (STLDI).

3. Allow employers to make better use of Health Reimbursement Arrangements (HRAs) for their employees.

Following the signing of the executive order, the U.S. Department of Health and Human Services (HHS) and Centers for Medicare and Medicaid Services (CMS) issued a statement announcing that the administration would no longer approve cost-sharing reduction (CSR) payments to insurance companies based on a legal opinion from the Attorney General. The CSR payments are used to provide healthcare plans with lower deductibles, co-payments and other out-of-pocket costs to be paid by low-income people.

So what has been the impact? Not much so far.

Major insurers seem to be committed to participating in healthcare exchanges. In articles in the New York Times and The Wall Street Journal, insurance company executives stated various levels of commitment to participating in the ACA for 2018. Some states are allowing insurers to increase premiums to account for the loss of CSR payments. The Attorneys General for 18 states have filed a lawsuit challenging the decision to stop the CSR payments.

And Congress is back in play. Potentially counteracting the HHS announcement, bipartisan discussions spearheaded by the U.S. Senate’s Committee on Health, Education, Labor and Pensions may lead to legislation that will continue cost-sharing reduction (CSR) payments to insurance companies providing health insurance policies on government healthcare exchanges and extend greater flexibility to states in developing solutions to their healthcare challenges for another two years.

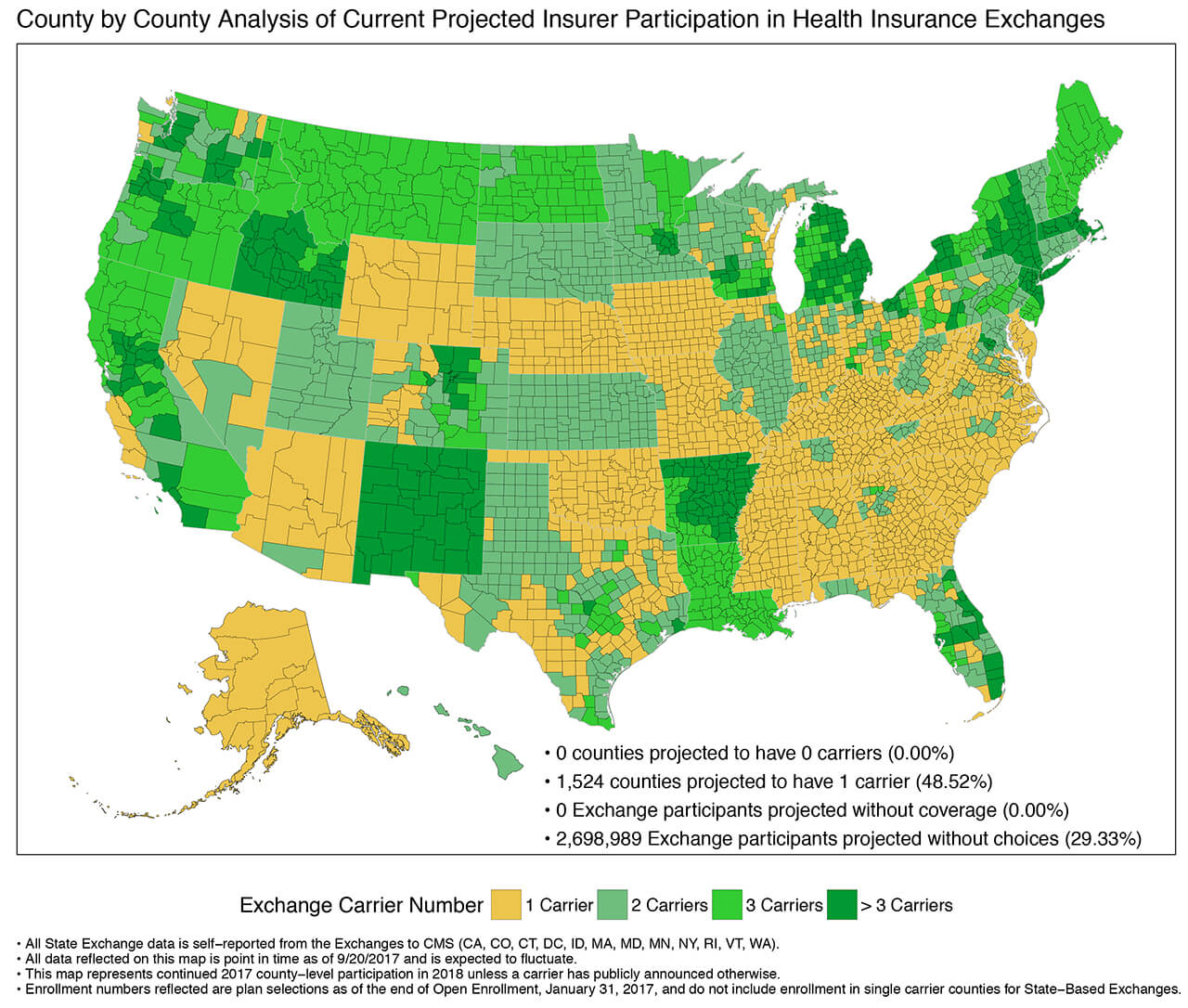

For its part, HHS said it would help states manage issues with insurers where regulators required insurance companies to file rates based on the assumption that CSR payments would continue. The assistance will be needed to provide some certainty to markets. While there are currently no counties across the country projected not to have some insurance coverage, a map provided by the Center for Consumer Information & Insurance Oversight shows more than 1,500 or 49%, are expected to have only one insurance carrier offering coverage.

A Congressional Budget Office report has said that termination of CSR payments could increase healthcare premiums by 20% in 2018 and increase the federal budget by $194 billion over the next decade.

In the meantime, it’s unsure how quickly the federal departments of Labor, Treasury and HHS will be able to investigate and draw conclusions about how the three areas identified as ways to provide better alternative healthcare coverage for Americans can or should be implemented.

Out of all this, one thing is clear. People should expect fewer plan options and higher premiums for plans on many exchanges when enrollment for 2018 starts next month in a healthcare marketplace that has become more uncertain and chaotic. That prognosis may change if a legal decision or some action in Congress takes place to provide for the continued payment of CSR payments.

As for employers, nothing has really changed. The ACA, remains the law of the land. The employer mandate remains in place. The IRS continues to prepare to accept the ACA-mandated filings for the 2017 tax reporting year.