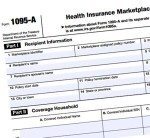

The Treasury Department has expanded for taxpayers who received incorrect 1095-A from the government after purchasing Affordable Care Act health insurance through a state online marketplace.

The Treasury Department has expanded for taxpayers who received incorrect 1095-A from the government after purchasing Affordable Care Act health insurance through a state online marketplace.

The agency gave these taxpayers the same as previously provided to those who bought through the federal marketplace: they will not have to refund any overpayment they received after filing their federal taxes using the incorrect information on the form, nor will they have to file an amended return.

In February, the Department of Health and Human Services (HHS) announced that some enrollees in the Health Insurance Marketplace received incorrect

Treasury announced that those who obtained insurance through the federal exchange did not have to file an amended return and could keep any excess tax refund they received. The additional action just announced extends the same relief to taxpayers who obtained through a state exchange.

HHS has corrected forms.