The IRS has extended by almost two months the due date for providing employees with Affordable Care Act information forms, and provided an extra three months for filing the required information forms with the IRS.

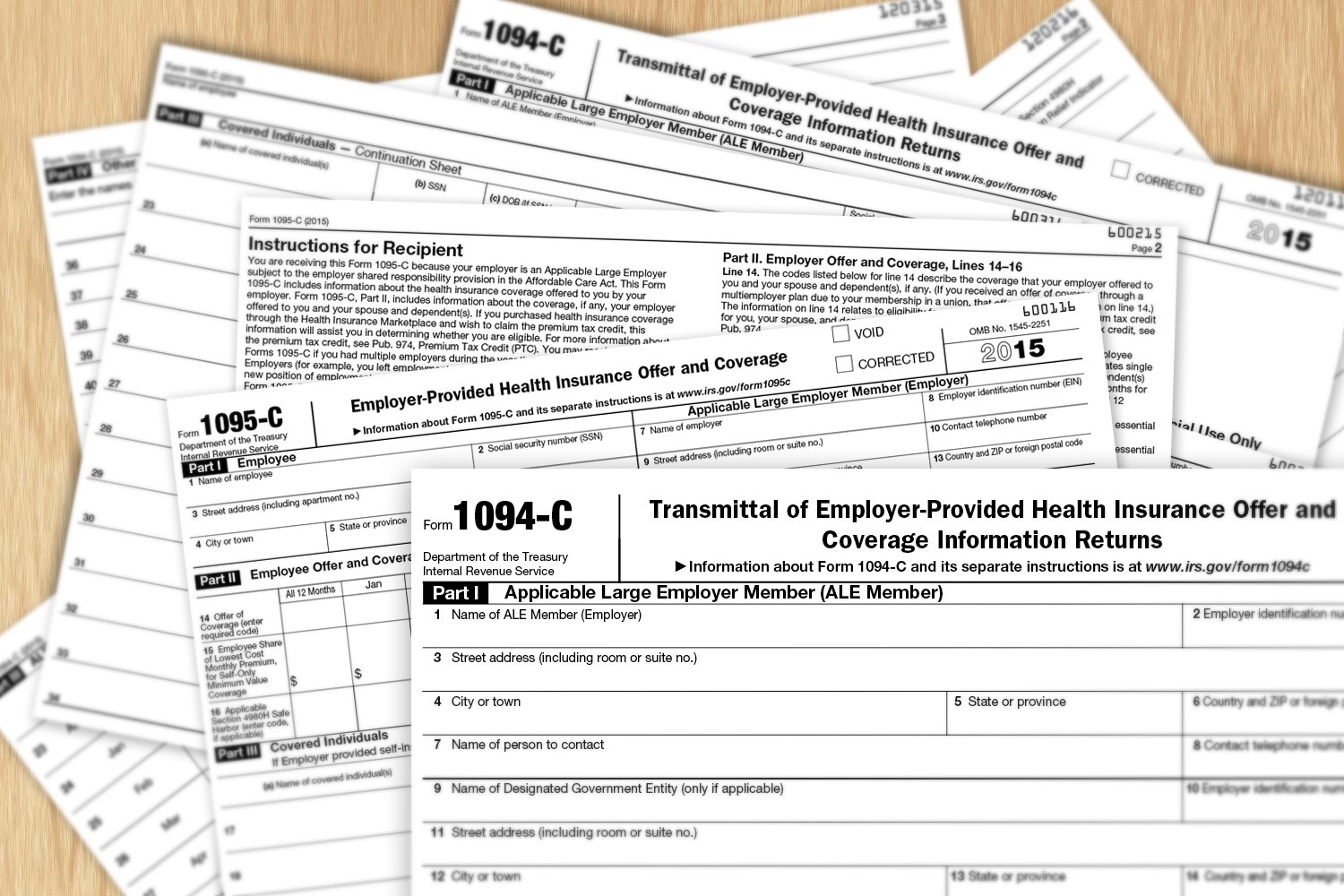

The date by which employers must provide employees with Form 1095-B and Form 1095-C, detailing the coverage provided, is extended from Feb. 1, 2016 to March 31. The deadline for filing Form 1094-B, 1094-C and Form 1095-B with the IRS was moved from Feb. 29, 2016 to May 31 if the forms are filed on paper, and from March 31 to June 30 if they are filed electronically.

If an individual needs information contained on one of these forms to complete their personal income tax returns, the IRS advises these taxpayers to file with whatever information they can obtain from their employer. If that later turns out to be inaccurate, the agency will not require the taxpayer to file an amended return.

The Treasury Department and the IRS said they decided to extend the deadlines “following consultation with stakeholders” who had faced penalties if they filed the required forms late or with incorrect or incomplete information.

The 2015 forms affected, and the new deadlines, are:

- Form 1095-B, Health Coverage Information Returns (March 31)

- Form 1094-B, Transmittal of Health Coverage Information Returns (May 31 if submitted on paper, June 30 if transmitted electronically)

- Form 1095-C, Employer- Provided Health Insurance Offer and Coverage (March 31)

- Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns (May 31/June 30)

The agencies said that employers and other coverage providers who have their information statements completed before the new deadlines are encouraged to file them as soon as possible.

For employers who had previously requested and received automatic extensions of time to file the required forms will not be able to apply those extensions to the new deadlines.

However, employers who will not be able to provide complete and accurate filings by the extended due dates are still encouraged to file reports with whatever information they have, said the IRS. The agency “will take such furnishing and filing into consideration when determining whether to abate penalties for reasonable cause.”

The agency said it will look at whether the employer made “reasonable efforts to prepare for reporting the required information” to the IRS and furnishing it to employees. These efforts could include gathering and transmitting the data to a consultant to prepare the data for submission to IRS, or testing the company’s ability to transmit information to the agency.