Over the past few months, the IRS has been moving forward with preparations for the ACA-mandated filings for the 2017 tax reporting year. Here’s what we know so far about the 2018 filing season.

The new instructions and forms are available for Applicable Large Employers (ALEs), which are organizations with 50 or more full-time or full-time equivalent employees.

The IRS has posted final forms and instructions for 2017.

IRS Forms 1094-C and 1095-C are used in determining whether a qualified employer owes a payment under the employer shared responsibility provisions under the ACA.

The new 2017 Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, is used to report to the IRS summary information and to transmit Forms 1095-C to the IRS. It also is used in determining the eligibility of employees for the premium assistance tax credit. You can get the form here.

The new 2017 Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is used to report information about each employee to the IRS and to the employee. You can get the form here.

You can find the instructions Form 1094-C and Form 1095-C at this link.

IRS Forms 1094-B and 1095-B are used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment under the ACA.

Form 1095-B, Health Coverage, is used to report this information. You can find the 2017 form and instructions under Current Products at this link.

Form 1094-B, Transmittal of Health Coverage Information Return, is the transmittal form that must be filed with the Form 1095-B. You can find the 2017 form and instructions under Current Products at this link.

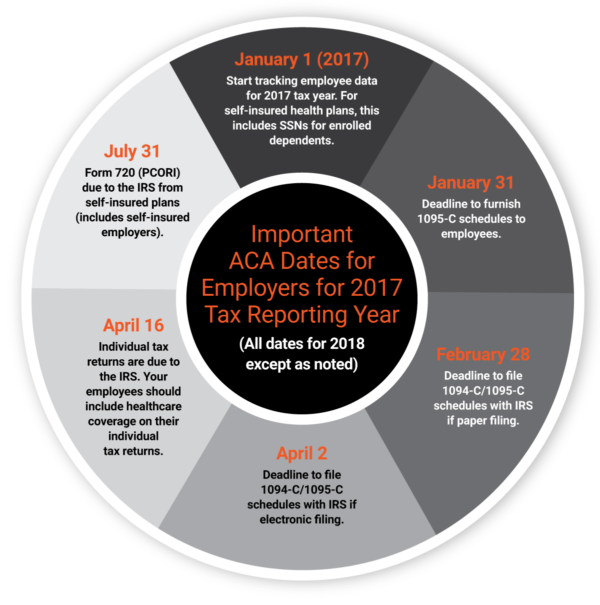

The IRS has issued the filing schedule reporting ACA information for the 2017 tax year.

The new filing dates are in the following graphic:

Good faith effort and transition relief are no longer available.

The updated instructions for the use of Form 1094-C and Form 1095-C in 2017 notes that Section 4980H transition relief for ALEs is not available for 2017 as it was for the 2015 and 2016 tax reporting years. The 2017 instructions have been revised to remove discussion of section 4980H transition relief. Form 1094-C also has been revised to reflect the change. The loss of good faith effort makes the use of accurate data in ACA compliance filings with the IRS will be even more critical than ever for the 2017 tax reporting year.

The employer mandate and individual mandate will be enforced.

IRS staff have released letters sent to members of Congress that indicate that the ACA employer mandate and individual mandate will be enforced. You can find the letters at these links:

In addition, the IRS’s ACA Information Center for Taxpaying Professionals is providing updated guidance that it will require taxpayers to provide an indication of whether they had healthcare coverage in 2017, as required by the ACA when electronically filing 2017 tax returns. The IRS also said that paper returns that do not contain the ACA information may be suspended until the IRS receives additional information. This may delay any tax refunds.

You can find the guidance here.

The IRS may start sending penalty notices to companies that have not followed ACA requirements before the end of the year.

As for enforcement, the agency is expected to start sending notices of penalty assessments by the end of the year for those companies who did not comply with ACA provisions and IRS filing requirements for the 2015 tax year. Read more information here.