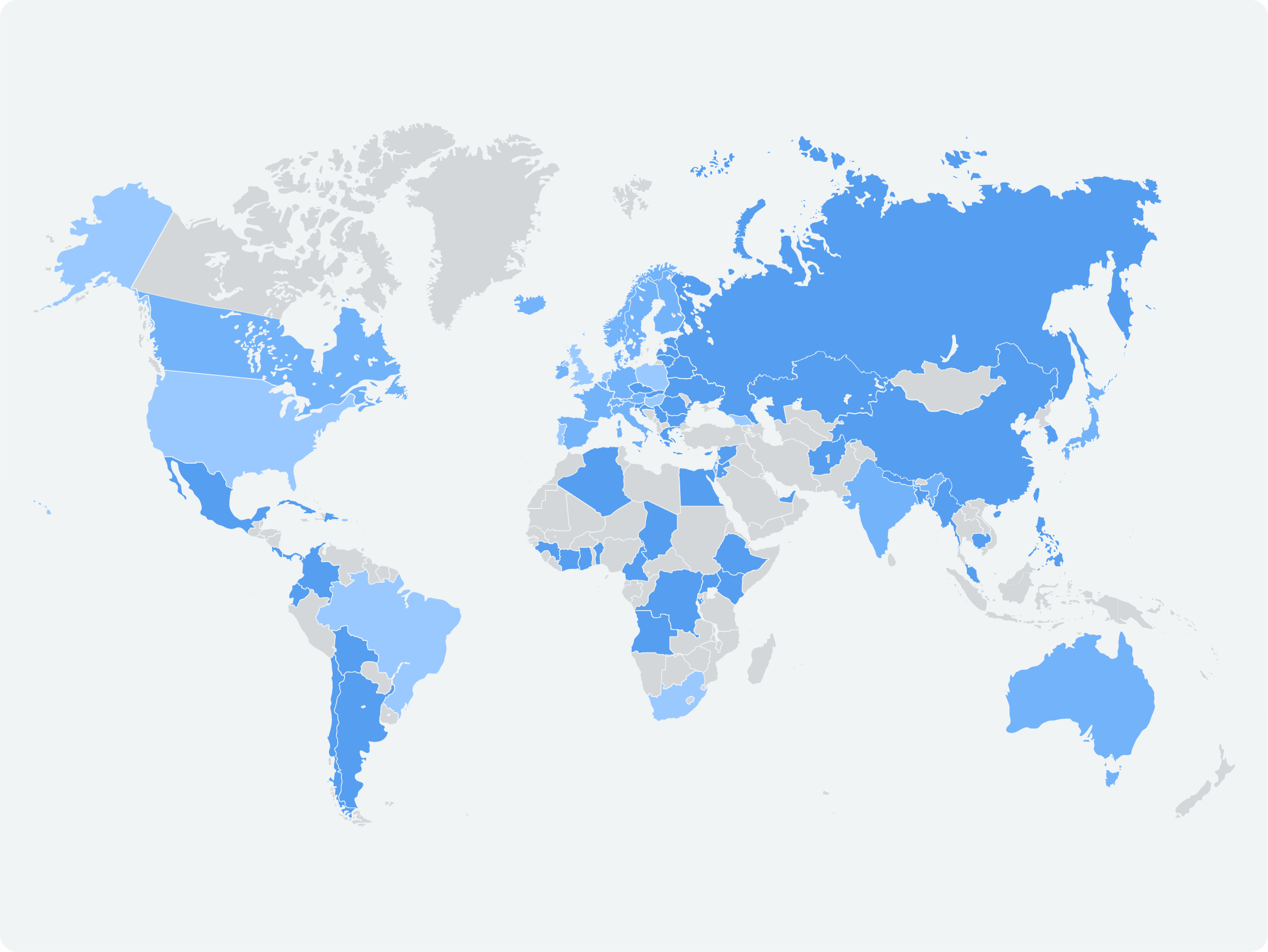

ACA compliance

Welcome to the new home of The ACA Times: Access the latest ACA compliance insights

The Cost of Non-Compliance: How Small Errors Lead to Big Penalties

Less Than a Week Until the March 31 ACA Filing Deadline — Are You Ready?

ACA Tracking Simplified: Why Our Time-Series Database Beats the Competition

IRS Initiates Issuance of Letter 5699 for 2023 Tax Year

Built by Experts, Trusted for Compliance: The Smarter Way to ACA

2024 Tax Year ACA Deadlines You Need to Know

How Bi-Directional Integrations Reduce Errors and Improve Efficiency

How to Avoid IRS Rejection This ACA Filing Season