You can expect to see a slight increase in IRS penalties related to the Affordable Care Act for the 2018 and 2019 tax filing seasons, which reflect reporting for the 2017 and 2018 tax years, respectively.

These penalties apply to Applicable Large Employers (ALEs), which are organizations with 50 or more full-time or full-time equivalent employees.

Penalties for Section 6721/6722 address the failure to accurately and completely file returns with the IRS and a failure to accurately and completely furnish statements to the applicable employees, i.e., the IRS 1094/1095 Schedules. For the 2017 tax year, these penalties can reach $260 per individual employee return. For the 2018 tax year, these penalties increase to $270 per individual employee return. Those penalties can add to more than $6 million for combined filing and employee statement distribution failures. Moreover, the employer penalties are double for a willful failure, which the employer bears the burden to show that any failure to comply was despite reasonable diligence.

Penalties for Section 4980H include two types of employer shared responsibility payments for ALEs. This is levied on ALEs who fail to offer minimum essential coverage to 95 percent of their full-time employees. Remember that an ALE includes all businesses that are sufficiently related under the IRS employer aggregation rules. We’ll refer to the first one as the “A” penalty. The penalty for not providing such coverage for 2017 is $2,260, multiplied by the total number of full-time employees.

We’ll call the other category of employer shared responsibility payment the “B” penalty. This applies to ALEs who offer minimum essential coverage to a sufficient number of full-time employees (and their dependents) so as not to be liable for the employer shared responsibility “A” penalty. However, this ALE will still owe the “B” penalty for each full-time employee if: (1) the minimum essential coverage the employer offers to the employee is not affordable, (2) the minimum essential coverage the employer offers to the employee does not provide minimum value; or (3) the employee is not one of the at least 95 percent of employees offered minimum essential coverage. The “B” penalty for not providing such affordable, minimum value coverage for the 2017 tax year is $3,390, multiplied by the number of full time employees who receives a tax subsidy for purchasing coverage through the government healthcare marketplace.

The IRS has announced that it will be enforcing the employer shared responsibility payments and penalties. ALEs who have failed to provide the mandated ACA. information and filings with the IRS since 2015 have not yet received penalty notices. However, they are coming. IRS staff have indicated that penalty notices for the 2015 tax year may be sent by the end of this year.

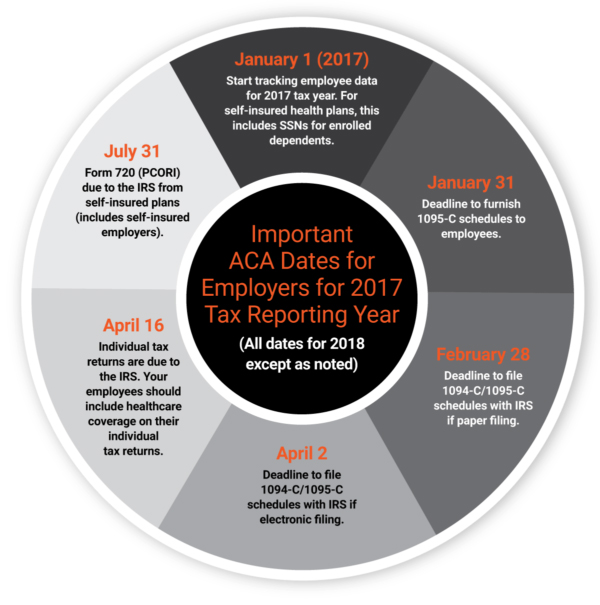

This graphic provides the important dates ALEs need to keep in mind for providing ACA information in 2018 related to the 2017 tax reporting year.

If you haven’t started gathering the data necessary to complete the required ACA filings with the IRS, you are behind schedule. Time to get moving. If you feel overwhelmed, consider hiring a third-party expert to help you consolidate your data to get on track for meeting IRS deadlines.