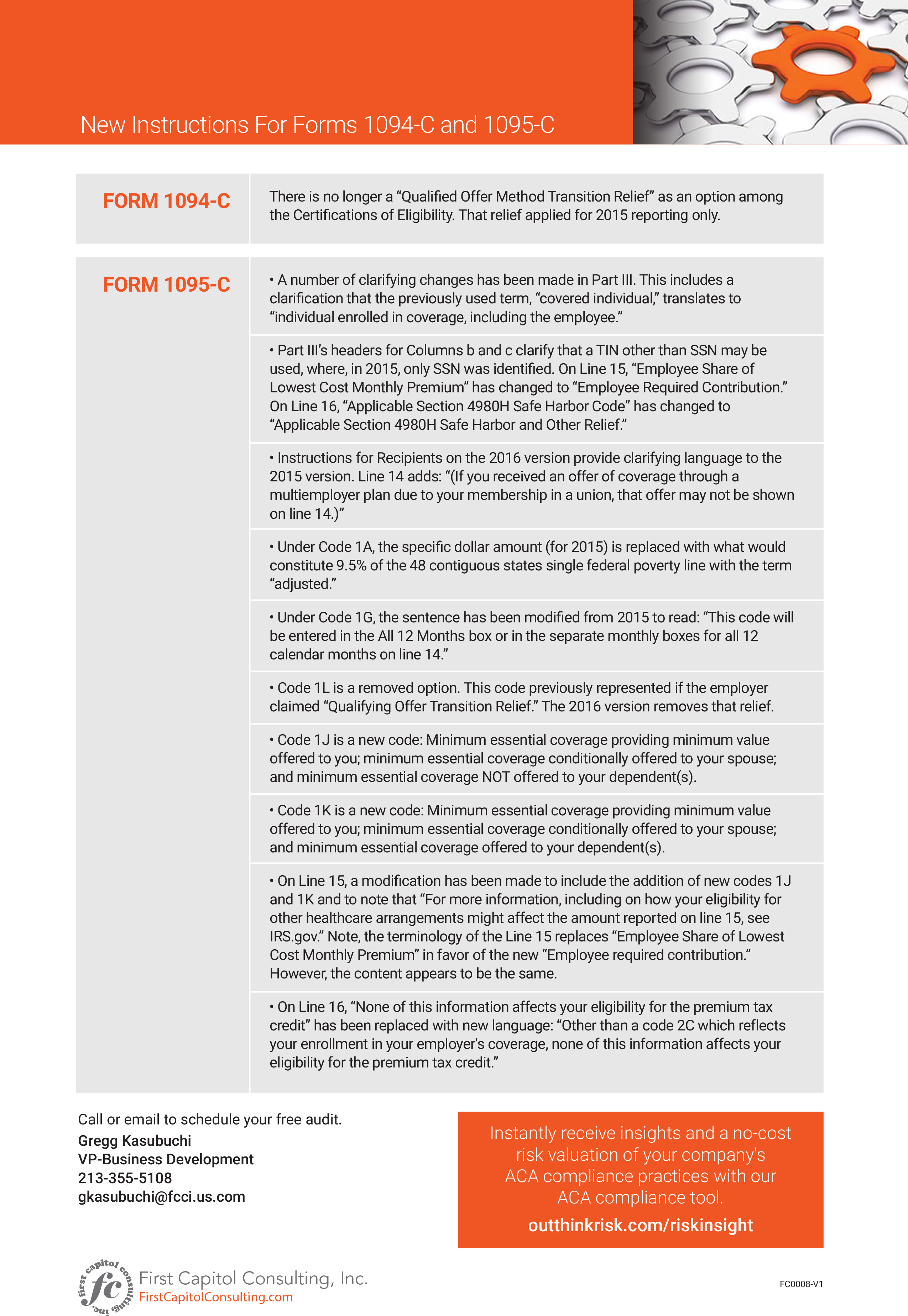

As the IRS released the final forms for 2016 Form 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns) and 2016 Form 1095-C (Employer-Provided Health Insurance Offer and Coverage), changes were made, particularly to the aforementioned latter form. The instructions for filing with changes have also arrived. The ACA Times has etched out these instructions in our infographic. Pay attention to key dates, as ACA compliance will still be mandatory for filing for 2016 and 2017 regardless of who takes office after November 8th. View the details of our infographic below.