2017 is just around the corner, and there’s news from the IRS on important changes. The IRS’s Notice 2016-70, arriving in IRB 2016-49 dated December 5, 2016, highlights some of the changes to come with ACA’s information reporting. Among them are an important date extension and the availability of good faith relief.

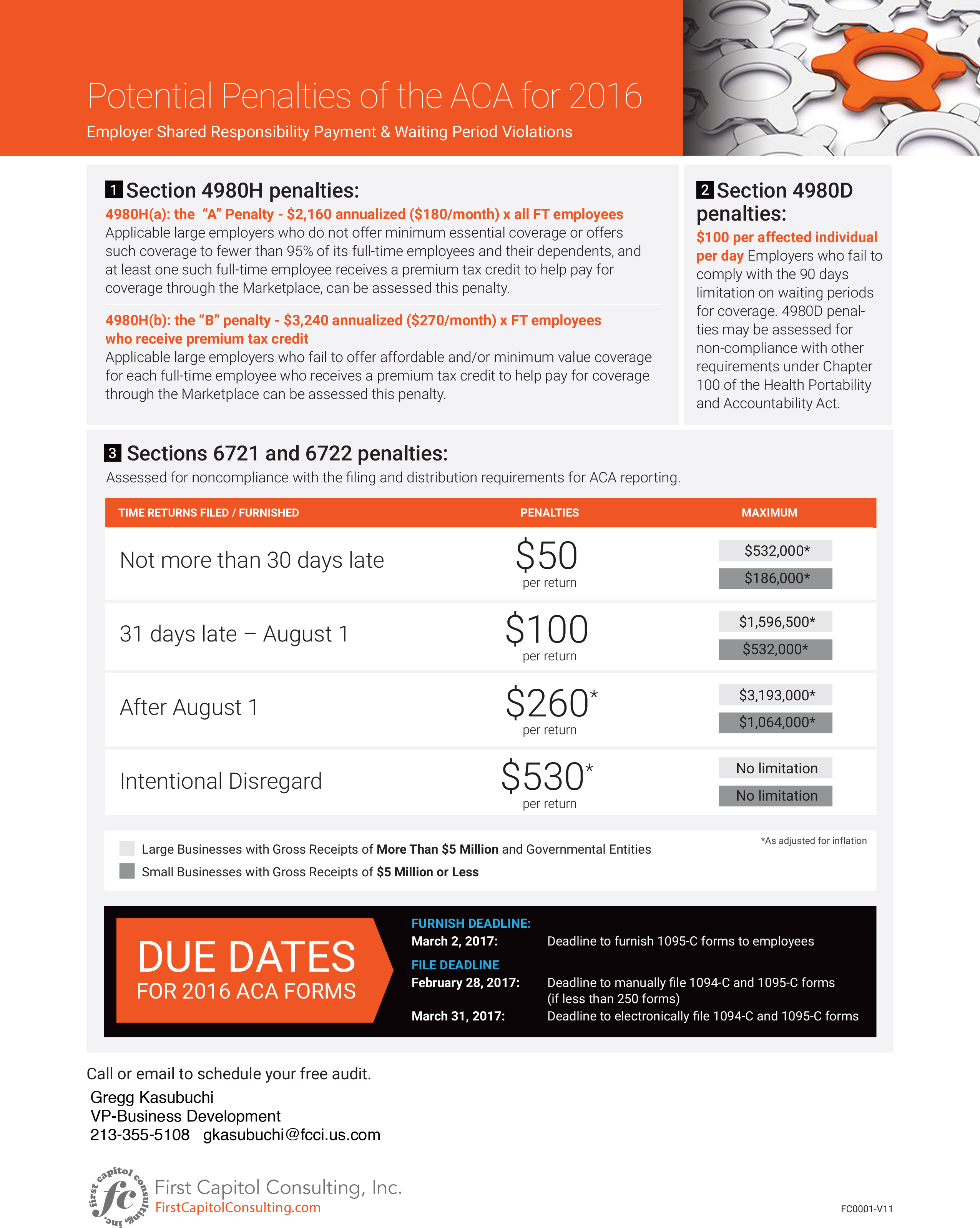

2016 Form 1095-B for Health Coverage, and 2016 Form 1095-C for Employer-Provided Health Insurance Offer and Coverage have been extended from January 31, 2017 to March 2, 2017, meaning that employers have an extra month to furnish these forms to their employees. This doesn’t affect the employees’ ability to file their tax returns; but it does delay their receipt of the forms for their records.

Further, those employers who fear paying penalties due to ACA reporting violations may see some relief if good faith can be shown. Per the new Notice, the IRS has allowed for “transitional good-faith relief” regarding penalties for violations from Sections 6721 (Failure To File Correct Information Returns) and 6722 (Failure To Furnish Correct Payee Statements) of the Internal Revenue Code. The IRS’ highlight of such relief as “transitional” signals that such relief will not necessarily be available in 2018.

Here are free resources to assist your business with the upcoming ACA reporting.

Below is an infographic with the updated deadline and the potential penalties.