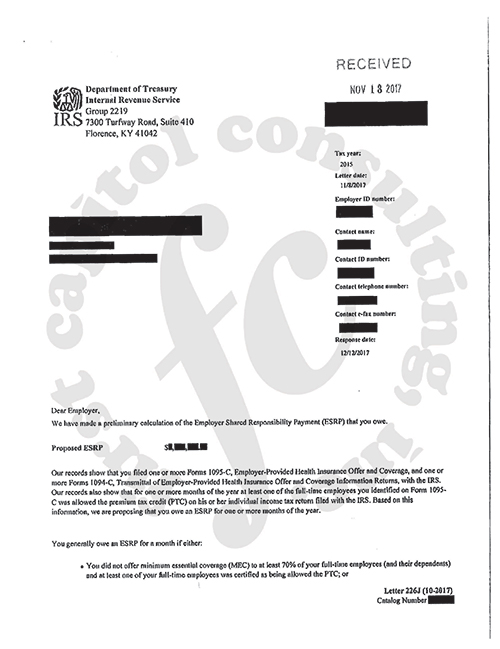

The letter no one wants is now in the mail!

(click the image for the full letter)

(click the image for the full letter)

Applicable Large Employers (ALEs), employers with 50 or more full-time or full-time equivalent employees, are starting to receive the IRS’s Letter 226J. The letters are being sent to ALEs the IRS believes have failed to comply with the requirements of the employer mandate under the Affordable Care Act (ACA) for the 2015 tax year. We have heard reports of letters anywhere from the tens of thousands of dollars to nearly six million dollars. We’re sure there are some that are even higher.

If you receive Letter 226J, what should you do?

ALEs receiving Letter 226J need to do the following:

- Contact your ACA solutions provider. Find out how you should proceed and if they will be assisting you in responding to the IRS.

- Review the data that was submitted as part of the 2015 ACA filing with the IRS to identify any errors in the information provided in the IRS letter.

- Provide the requested information to the IRS by the response date shown in the letter, which generally will be 30 days from the date the letter was issued. The letter will contain the name and contact information of a specific IRS employee that the ALE should contact if the ALE has questions about the letter.

- Respond in writing, either agreeing with the proposed employer shared responsibility payment or disagreeing with part or all of the proposed penalty assessment. You should have backup documentation to justify your disagreement. The letter will provide instructions on how the ALE should respond.

- Request a pre-assessment conference. If the ALE disagrees with the proposed or revised ESRP payment. Following this conference with the IRS, the ALE may also ask the IRS Office of Appeals to review the case.

The IRS will acknowledge any response to Letter 226J with a Letter 227.

What happens if an ALE doesn’t respond?

The IRS will assess the amount of the proposed ESRP shown in Letter 226J, and will issue a Notice and Demand for Payment (Notice CP 220J). This Notice offers directions and alternatives to pay the penalty.

What happens if the ALE agrees with the proposed ESRP?

The ALE may complete, sign, and date the enclosed Form 14764, ESRP Response, and return it to the IRS by the response date. If the ALE doesn’t pay the entire agreed-upon ESRP, it will receive a Notice and Demand notice for the balance due.

ALEs that receive Letter 226J only will have 30 days from the date of the letter to respond. Failing to do so could lead to a significant IRS penalty assessment for your client and, possibly, an IRS audit.

If your organization was not taking seriously the possibility of receiving an IRS penalty notice for failure to comply with the ACA, now is the time to rethink that strategy.

For more background on Letter 226J, click here.