With the stunning election of Donald Trump as President comes a serious question of what happens to the Employer Mandate under the Affordable Care Act (ACA), also known as “Obamacare.” Just two weeks before Election Day, facing headlines of premiums spikes on the healthcare exchanges, Trump hammered on his announcement that he will “repeal and replace Obamacare.” With a majority in both houses of Congress, Trump looks poised to do so.

But with six years since its enactment, the ACA is a complex set of rules with a massive and now firmly entrenched regulatory framework. So, what does a Trump administration mean for the enforcement of the Employer Mandate, just one provision in the ACA of which Trump has never spoken?

While there remains a lot of speculation as to the extent of “repeal and replace Obamacare,” and presumably, its Employer Mandate provision, what is clear is that it is not going to be a quick process. An important corollary of repeal is the need to replace. The interplaying provisions of the ACA cannot be repealed without causing a catastrophic loss of coverage to 22 million insured.

Among the interplaying provisions are the provisions on the Employer Mandate, Individual Mandate, premium tax credits and healthcare exchanges. Even Speaker Paul Ryan’s “Better Way” proposal – while not fleshed out – calls for a tax credit for insurance coverage, critical for lower income individuals to get health coverage. HR 3762, a bill using the “reconciliation process” of the federal budget (and hence avoiding filibuster but vetoed in December 2015) offers only a framework of what provisions could be repealed but with no replacement let alone any details of that replacement.

Replacement legislation and its enforcement regulations are unlikely to be ready to be effective before 2019. Consider that the ACA was enacted in 2010 but the Employer Mandate did not get enforced until 2015.

What this should signal to employers is that there is likely at least another two years during which the Internal Revenue Service will enforce the Employer Mandate. The IRS does so by means of imposing two separate sets of penalties on employers:one set for failing to offer adequate healthcare coverage to its employees under Internal Revenue Code (IRC) Section 4980H and another set for failing to furnish employee disclosure statements and for failing to file information returns regarding the employees’ healthcare coverage status under IRC Sections 6721 and 6722.

These information returns are then reconciled with the individual’s tax returns to assess whether tax subsidies already paid out to such individuals were properly given. In addition to determining whether the penalties under Section 4980H and/or Sections 6721 and 6722 should be imposed on the employers, these information returns allows the IRS to reconcile whether penalties should be assessed on individuals who failed to obtain healthcare coverage under the Individual Mandate.

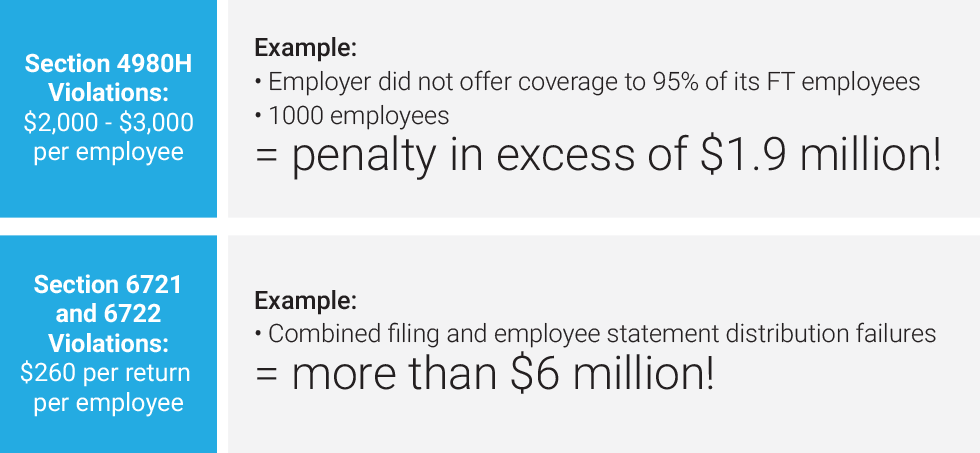

The penalties to employers can be huge. The penalties for Section 4980H violations consists of more than $2,000 per employee or more than $3,000 per employee penalty depending on the nature of the failure. For example, if the employer did not offer coverage to 95% of its full time employees and it had 1000 employees, that means the penalty could be in excess of $1.9 million.

Additionally, the penalties for Sections 6721 and 6722 violations can reach $260 per return (which is on an employee basis), adding up to more than $6 million for combined filing and employee statement distribution failures. Indeed, the employer penalties are double for a willful failure, which the employer bears the burden to show that any failure to comply was despite reasonable diligence.

These employer penalties are the source of funding of the premium tax credits (PTCs), which the government has already paid out. The funds are desperately needed in view of an existing, enormous federal deficit, which Republicans have consistently vowed to reduce. Accordingly, there is little incentive to change the status quo and eliminate the IRS enforcement of the Employer Mandate until and unless the Employer Mandate itself is repealed.

In view of the hefty penalties and with only two months before 2016 ACA reporting is due, it’s a no brainer for employers. The cost of compliance is miniscule compared to the staggering cost of penalties for non-compliance.