Accurate ACA compliance starts with accurate data tracking. Many employers rely on outdated systems that overwrite historical data, making it nearly impossible to track employee status changes over time. This leads to miscalculations in full-time equivalency, incorrect eligibility determinations, and increased risk of penalties.

Trusaic’s ACA compliance solution takes a different approach. Our time-series database captures historical snapshots of employee data, ensuring full visibility into workforce changes and compliance obligations over time. Unlike traditional systems that only store current data, our solution maintains a comprehensive, audit-ready history, making it the most reliable choice for ACA compliance.

The Limitations of Traditional ACA Tracking Systems

Most ACA compliance solutions on the market today rely on static data models, which have major limitations:

- Data Overwrites: Traditional systems update employee records each month but do not retain historical versions. This makes it difficult to reconstruct past eligibility determinations if an audit occurs.

- Limited Visibility: Without a time-series approach, employers lose insight into how an employee’s full-time equivalency (FTE) status evolved over time.

- Compliance Gaps: Employees transitioning between EINs, job classifications, or measurement periods may have gaps in their ACA data, leading to inaccurate coverage offers or reporting errors.

- Increased Audit Risk: If the IRS questions a past filing, many traditional systems lack the historical data necessary to verify compliance, leaving employers exposed to penalties.

How Our Time-Series Database Solves These Challenges

Trusaic’s time-series database sets a new standard for ACA compliance tracking by maintaining a historical record of every data point. This allows for accurate, defensible compliance management, even in complex scenarios.

1. Historical Snapshots for Every Employee

- Our system doesn’t overwrite data — instead, it logs every change, creating a full audit trail of an employee’s status.

- Employers can review past records at any point in time, ensuring accurate reporting for IRS audits or internal reviews.

2. Seamless Tracking of Full-Time Equivalency (FTE)

- FTE status isn’t just a monthly calculation — it’s a cumulative measurement over time.

- Our database stores and analyzes historical work hours, ensuring that employees crossing the 30-hour threshold are correctly classified and offered coverage when required.

3. Managing EIN Transitions and Job Changes

- Employees who transition between EINs, departments, or measurement periods often experience tracking issues in traditional systems.

- Our time-series database connects employee histories across these transitions, ensuring seamless compliance and eligibility determinations.

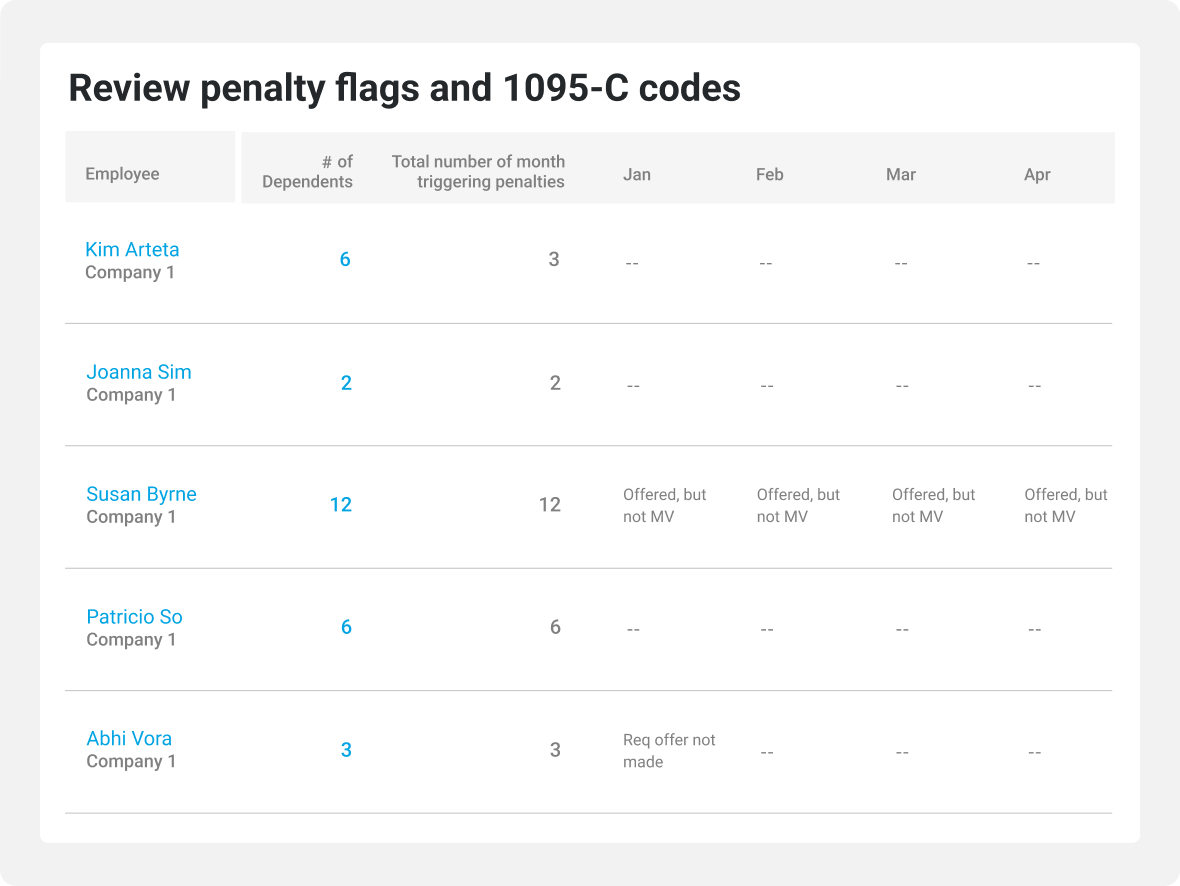

4. IRS-Ready Audit Protection

- Every piece of data remains accessible and reportable, allowing employers to defend ACA filings with concrete historical evidence.

- If the IRS issues Letter 5699 or Letter 226J, employers using our system can quickly retrieve supporting documentation to mitigate penalties.

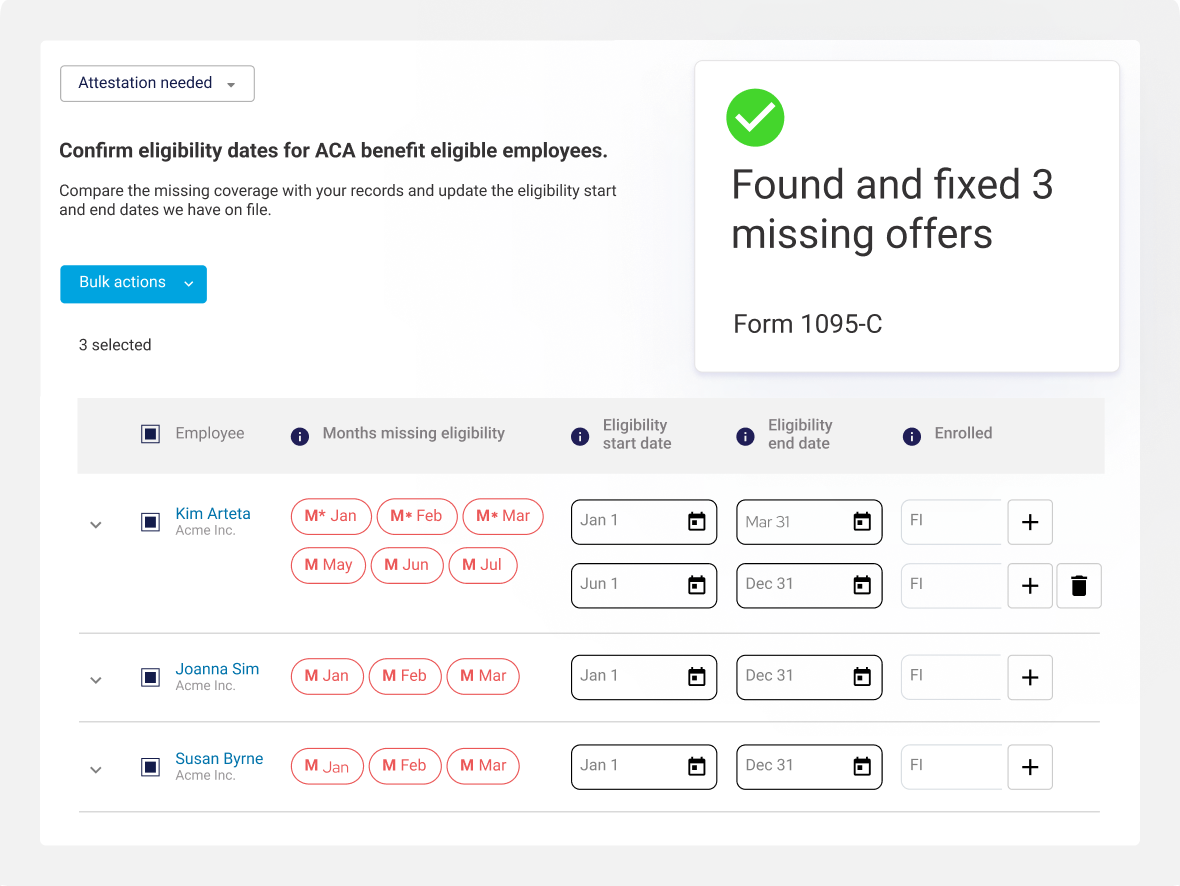

Real-Time Visibility with Actionable Insights

Employers need more than just accurate data — they need an intuitive way to access and interpret it. Our system provides:

- Interactive Dashboards: View historical ACA tracking trends and identify potential compliance risks before they escalate.

- Automated Alerts: Receive notifications when employees approach eligibility thresholds, so coverage can be offered proactively.

- Audit-Ready Reports: Generate detailed compliance reports with a single click, ensuring that all ACA filings are backed by verifiable data.

Why Historical Data Integrity Matters for ACA Compliance

The ACA’s Employer Mandate requires precise tracking of employee eligibility and accurate IRS reporting. By maintaining a time-stamped history of every change, our system guarantees:

- No more guesswork when determining full-time status.

- Legally defensible ACA filings backed by robust data records.

- Peace of mind knowing compliance efforts are fully documented and audit-ready.

Experience the Difference with Our Time-Series Database

Employers can’t afford to rely on outdated systems that risk data integrity. Trusaic’s ACA solution provides the most accurate, defensible, and audit-ready compliance tracking available.

Want audit-ready data at your fingertips? Request a demo to see our innovative time-series database in action today.