The IRS began issuing Letter 226J penalties for the 2022 tax year in November. It was only 10 months earlier that the agency was issuing penalties for the 2021 tax year.

Moving to the next tax year in less than 12 months is the latest sign that the agency has ramped up its ACA enforcement efforts. If your organization receives a Letter 226J penalty from the IRS, Trusaic can help you resolve it.

Why Does the IRS Issue Letter 226J Penalty Notices?

The IRS issues Letter 226J notices to organizations it believes failed to comply with the ACA’s Employer Mandate for a particular tax year, and had at least one full-time employee receive a Premium Tax Credit (PTC) from a state or federal healthcare marketplace.

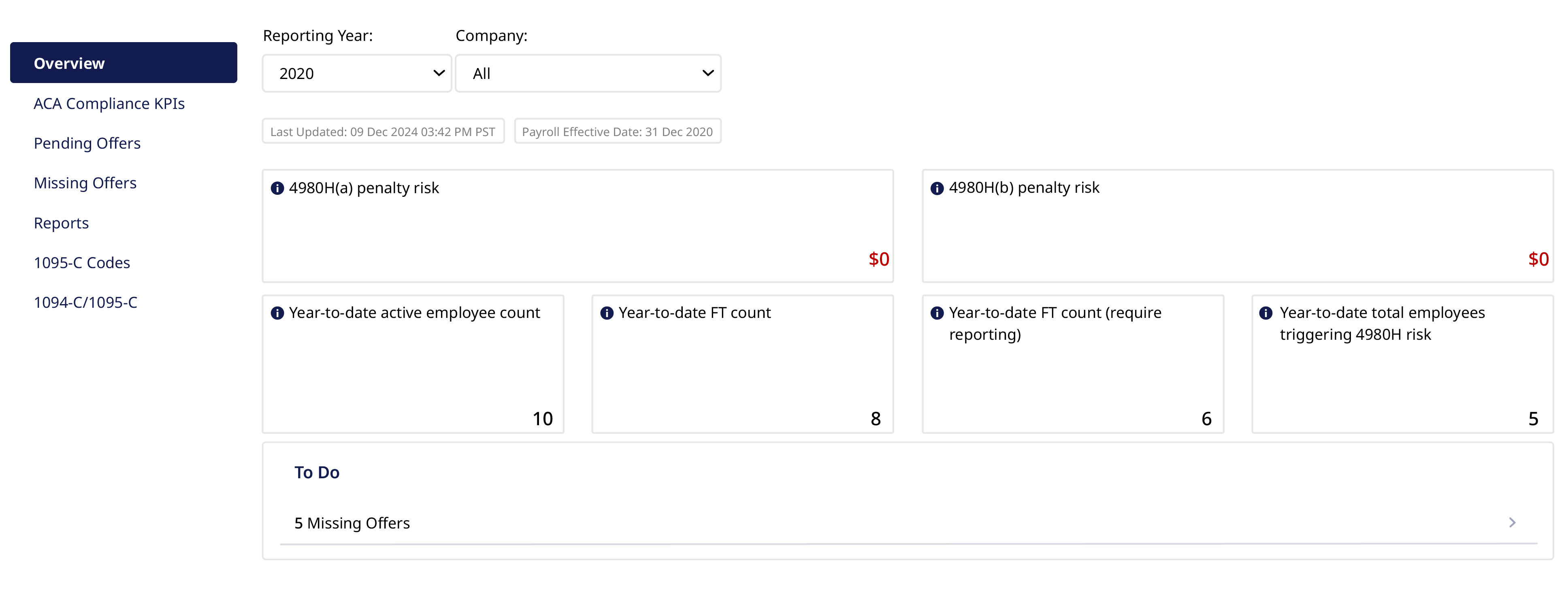

Trusaic’s ACA Complete software will give you full visibility into your penalty risk for a given tax year. This ensures you aren’t caught off guard and can move quickly to eliminate non-compliance triggers.

The Letter 226J will indicate which of the organization’s employees received a PTC, along with the months they received one. If an employee receives a PTC, the IRS will reference the employer’s 1095-C filings and check to see if the employee who received the PTC was offered Minimum Essential Coverage (MEC) that met Minimum Value (MV) and was affordable.

The 4980H(a) penalty amount shown in Letter 226J is calculated based on the full-time counts reported in the annual ACA filings for the relevant tax year.

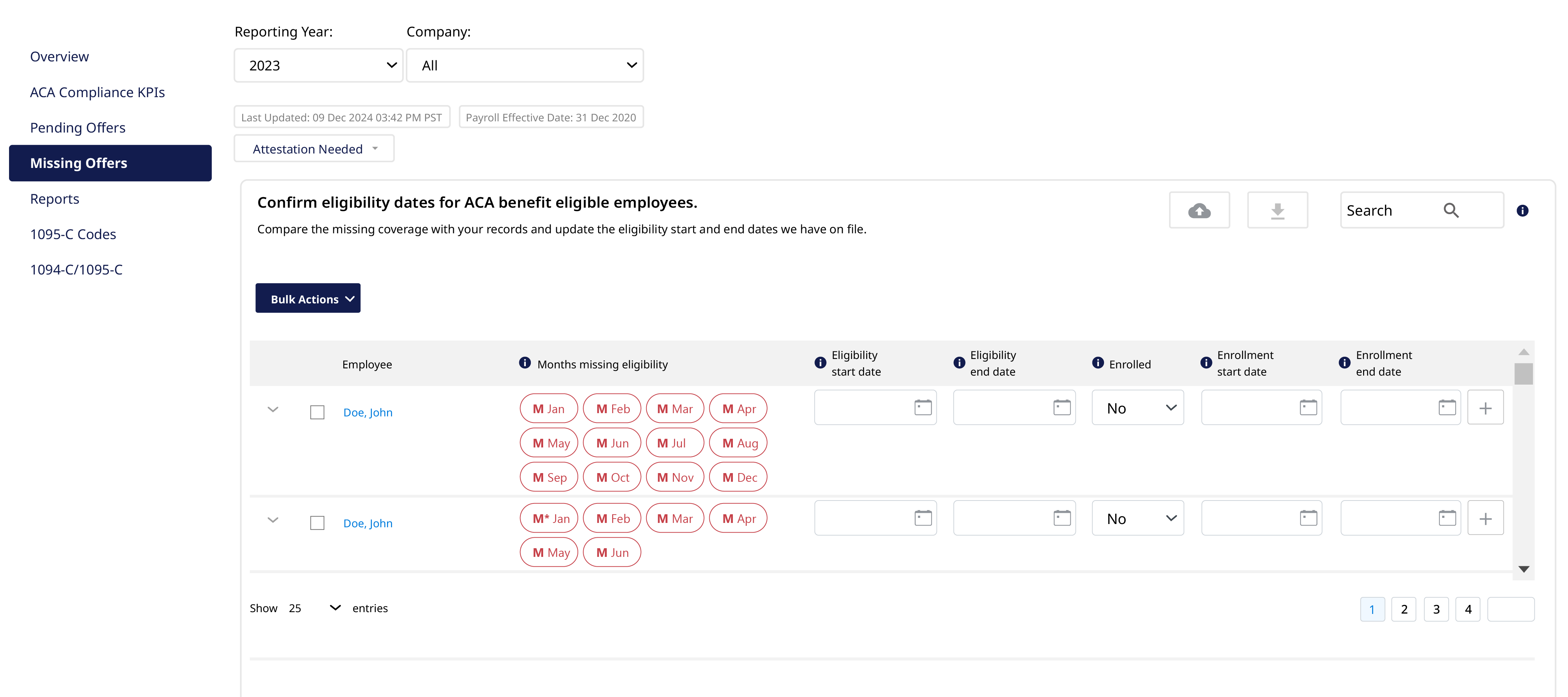

The 4980H(a) penalty would be assessed if MEC coverage was not offered to 95% of FT employees (and their dependents). This is why it is so important to offer coverage to 95% of FT employees (and dependents). Trusaic’s ACA Complete Software informs you if employees are missing an offer or will require an offer in the next few months — ensuring the 95% MEC offer threshold is met.

The 4980H(b) penalty is calculated based on the number of PTC recipients who weren’t offered affordable MV coverage, which is also tracked through Trusaic’s ACA Complete Software.

How Trusaic Helps With IRS Penalty Letter Response

Getting a Letter 226J penalty issuance from the IRS can be an unsettling experience. Time is of the essence when you receive one. You have 30 days to respond, although you may request an extension of up to 30 days.

Contact Trusaic to help you with the response. We will work with you to eliminate the penalty through a nine-step process:

- Review 1094-Cs and 1095-Cs for PTC listed employees.

- Verify enrollment status of PTC employees.

- Verify offers of health coverage for non-enrolled PTC employees.

- Verify FT/LNAP Status of PTC employees.

- Verify affordability of offers made to PTC employees.

- Prepare PTC employee verification report.

- Calculate adjusted 4980H assessment.

- Correct PTC listing errors.

- Assist in crafting the response to Letter 226J.

Even after this extensive analysis, it is possible that some PTC employees were not offered affordable MV Coverage. In which case, we will work with you to get a penalty reduction by performing an accurate redetermination of the ACA data underlying the ACA filings for the 2022 tax year.

Our job is to eliminate or greatly reduce your IRS penalty amount. To date, we’ve helped our clients save over $1 billion in ACA penalty assessments. While other vendors might leave you to fend for yourself, a designated ACA expert from Trusaic will gladly assist you in your time of need.

Experience superior customer service and let us take care of this for you — it’s what we do.

What Are the 2022 Letter 226J Penalty Amounts?

Letter 226J penalty amounts can range in size, but we’ve seen fine amounts in the millions of dollars. Depending on whether the violation contains a 4980H(a) or 4980H(b) penalty will also determine the size of the fine.

The IRC 4980H(a) penalty is issued if an organization fails to offer MEC. It’s applied for every month that the employer fails to offer coverage to at least 95% of a company’s full-time employees and their dependents.

Meeting the 95% threshold requirement is pass/fail too. So, if you offer coverage to only 94%, the penalty will apply for every month you extend coverage to only 94%. What’s more is that the penalty will be applied against your entire full-time workforce. For the 2022 tax year, the monthly 4980H(a) penalty amount for a single employee is $229.17, or $2,750 annualized.

The 4980H(b) penalty for the 2022 tax year is $343.33 per employee, or $4,120 annualized. While the 4980H(b) penalty is higher than the 4980H(a), it’s assessed on a per-employee basis, i.e., for every instance an employee receives a PTC from a state or federal health exchange.

Because of this, Letter 226Js with 4908H(b) penalties tend to be smaller.

Eliminate Penalties from the Start

It’s no secret that the Internal Revenue Service received an influx of resources over the last several years, including $80 billion in funding and 87,000 new agents.

The recent developments of how quickly the IRS is identifying and assessing instances of ACA non-compliance are impressive and a clear indicator that the agency is putting the additional resources to work.

Some other things to watch out for now that the IRS is operating at greater speed include how the agency is assessing non-compliance. A new client of ours recently approached us regarding a Letter 226J notice they received which requested that they provide proof of ACA full-time calculations.

Best practices for navigating these developments include managing compliance with the ACA’s Employer Mandate proactively. That means monthly monitoring, a strict ACA documentation process, and a systematic method for calculating affordability each month. This is done for you with our ACA Complete software.

You have line of sight into when there are missing offers of coverage, potential 1094/1095-C code issues, and more to ensure you remain in compliance. And, if you receive a Letter 226J penalty from a previous tax year, a designated ACA expert from Trusaic will step in to assist you.

Superior software, superior service — it’s what we do.